Arval Beyond

Arval Mobility Observatory

15 Février 2024

Traduction en français en cours

Arval Mobility Observatory is pleased to share with you a synthesis of changes to statutory taxation and the associated mechanisms evolutions in Europe, by country.

As follows, you will find a non-exhaustive list highlighting the evolution of governmental taxation, grants and bonus schemes for 2024 in several European countries (Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Italy, Netherlands, Norway, Poland, Romania, Spain, Sweden, Switzerland, UK). You can check all or only one by selecting the respective country on the left side list below.

-

Belgium

-

Government subsidies linked to EVs (BEVs and PHEVs)

In the Flemish region, private individuals, non-profit organizations, and shared mobility providers can apply for a grant for the purchase of zero-emission vehicles (so also fuelcell vehicles but not PHEV), both new and used (categories M1, N1 and L7e-C).

Starting 2024, this grant is 5.000 euros for a new vehicle and 3.000 euros for a used car. The grant is structured on a decreasing scale, decreasing by 1.000 euros per year for new vehicles and 500 euros for used ones.

The grant is for vehicles registered as of January 1st 2024, used cars have had to be registered on the previous owner for at least 3 years and the first registration cannot be older than 8 years. The purchase price of the vehicle is maximum 40.000 euros VAT included. For used vehicles, the list price, options included, can not exceed 60.000 euros VAT included.

Purchases have to be done at a car dealer. A purchase from a private person is not within the scope.

No grants in the Walloon region nor on a national level.

Source: https://www.vlaanderen.be/premie-voor-aankoop-van-een-elektrische-wagen

-

Mobility Legislation

The federal government has confirmed two formulas for calculating the federal mobility budget. One based on the real costs of the last 4 years. The other on based upon reference vehicles.

The method of calculation has to be the same for all employees of the company. It is not a choice on employee level. After three years, the method can be changed.

Source: Royal decree Sept 10th 2023 regarding the mobility budget

-

Changes in taxation and Benefit in Kind (BIK) calculation

Everything in place remains the same for 2024, with the exception of the minimum BIK. This is 1.600 € for 2024.

Source: Administration générale Expertise et Support Stratégiques. - Service Règlementation

-

-

Czech Republic

-

Governmental subsidies

There shall be a new governmental subsidy for companies, SMEs and entrepreneurs launched at the end of Q1 2024 in the Czech Republic. The only approved way of financing to obtain the subsidy is a car credit provided by one of the approved credit companies which have a contract with the National Development Bank. No operational leasing, financial leasing or direct purchase is allowed for the subsidy.

There is an amount of 200.000 CZK (8.000 €) per each subsidized personal BEV, 250.000 CZK (10.000 €) per each eLCV and 300.000 CZK (12.000 €) per each subsidized FCEV or e-truck. No subsidies for PHEVs or HEVs.

From the same date as above there will also subsidies for private AC wallboxes (50.000 CZK = 2.000 €), DC (100.000 CZK = 4.000 €) and UFC (150.000 CZK = 6.000 €) charging stations available.

Complete clauses can be found on www.nrb.cz

For private individuals there is still a subsidy for AC wallbox available. But it can be obtained only in combination with major household development, insulation, renovation etc. Complete clauses can be found on https://novazelenausporam.cz/dokumenty/podminky-2023/

-

Taxation changes since 01st January 2024

New tax rule introduced concerning VAT deduction from purchase of company vehicles. VAT can be recovered only for vehicles with purchase price of maximum 2 mil. CZK incl. VAT (80.000 €). If the vehicle is more expensive no VAT can be recovered from the amount exceeding 2 mil. CZK.

Highway vignette price for the use of highways in CZ will increase its price from 1.500 CZK to 2.300 CZK (92 €) per year from 1 March 2024. PHEVs with CO2 emissions up to 50 g per km will pay 570 CZK (23 €) per year. BEVs and FCEVs do not need to have a highway vignette for highway usage.

-

Benefit in Kind

Since 1 January 2024 new rules are valid for Benefit in Kind.

If an employee is using company BEV or FCEV for private purposes his/her taxable income is increased by 0,25% of the vehicle purchase price incl. VAT.

If PHEV with CO2 emissions up to 50 g per km is used - the taxable income is increased by 0,50% of the vehicle purchase price incl. VAT.

If a vehicle with CO2 emissions exceeding 50 g per km is used the taxable income is increased by 1% of the vehicle purchase price incl. VAT

-

-

DENMARK

Benefit in Kind (BIK) calculation is slightly changes from 2024.

-

The taxation % on the car price up to 300.000 DKK is reduced by 0,5%

-

The taxation % on the car price above 300.000 DKK is increased by 0,5%

-

The environmental fee added factor multiplied with the ownership tax moves from 400% in 2023 to 600% in 2024.

-

-

FINLAND

-

Benefit in kind taxation in 2024

Employee and his/her family can use the employer’s car and this gives rise to a taxable company car benefit. The tax is based on the registration year.

Age group A (registration years 2022-2024)

-

Unlimited benefit: The monthly tax value 1,5 % percent of the replacement price of the vehicle + 300 €

-

Limited benefit: The monthly tax value 1,5 % percent of the replacement price of the vehicle + 105 €

Age group B (registration years 2019-2021)

-

Unlimited benefit: The monthly tax value 1,2 % percent of the replacement price of the vehicle + 315 €

-

Limited benefit: The monthly tax value 1,2 % percent of the replacement price of the vehicle + 120 €

Age group C (registration before 2019)

-

Unlimited benefit: The monthly tax value 0,9 % percent of the replacement price of the vehicle + 330 €

-

Limited benefit: The monthly tax value 0,9 % percent of the replacement price of the vehicle + 135 €

Replacement price is the general recommended retail price of the specific make and model. The amount is quoted at the date of purchase by the importer minus 3400 €. All extra accessories which exceed 1200 €, including additional home charger for PHEV or BEV, are included in the valuation. Home charger can be added as one of extra accessories starting from 2023. Winter tyres are excluded here as winter tyres are mandatory in Finland.

Car benefits are divided into two types: unlimited and limited benefit. Unlimited benefit includes all costs regarding usage of the car, fuel and/or electricity as well. Limited benefit includes other car-related costs than fuel and/or electricity.

The Finnish Government supports electrification strongly during years 2021-2025 as they have introduced a tax deduction scheme for “zero and low emission” company cars.

For EVs registered from 2020 for the first time, the taxable value is reduced by 170 €/month as well as a reduction of 120 €/month from the operating costs in unlimited benefit. For PHEVs, HEVs and CNG cars, vehicles with emissions which are from 1 to 100 grams/km (WLTP), the taxable value is reduced by 85 €/month, if the company car is registered from 2021 or later for the first time. There is an additional reduction of 60 € per month for plug-in hybrid or CNG car from operating costs of unlimited benefit. For every other fuel type (Diesel, Gasoline, etc…), the taxable value is reduced by 85 €/month as well if the emissions are included in 1-100 grams/km (WLTP). The Government has not confirmed will the support continue after next year or do we face some changes then.

Electric car purchase price does not include any car tax. All other fuel types include car tax based on the WLTP co2-emissions. For example, car tax for normal PHEV vehicles is less than a couple of thousand euros and car tax for normal diesel is three times higher.

Example of taxation value changes from age group A to age group B (2019-2021):

Car price 50 000 € - taxation value will decrease 70 €/month

-

-

FRANCE

-

Ecological Malus (CO2 Malus)

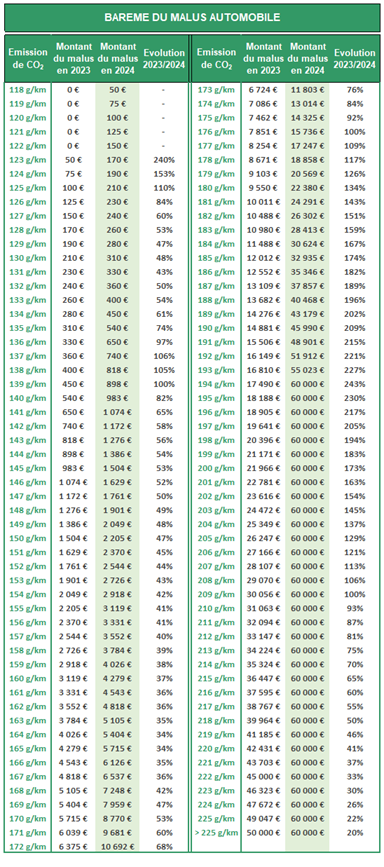

Since 1 January 2024, the CO2 malus starts at 118g/km, with a tax of 50 €. The high point for the malus is raised to 60.000 € (compared with 50.000 € in 2023), for 194 g/km of CO2.

The threshold of 1.000 € is reached this year at 141 g (1.074 €) compared with 146 g in 2023 and 151 g in 2022. It is from 176 g/km of CO2 that the malus is increasingly penalizing since its amount doubles over a year (15.736 € compared with 7.851 € in 2023).

-

Weight – Based Vehicle Malus

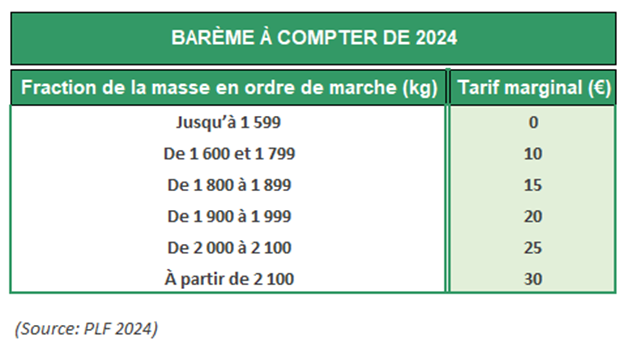

Change of threshold for weight-based vehicle malus, in 2024. Until now, the malus by weight was triggered at 1.8 tonnes with a tax of 10 € per kilogram exceeded.

Since 1 January 2024, it is triggered at 1.6 tonnes and follows a progressive scale in five thresholds, with fees ranging from 10 to 30 € per kilogram exceeded.

The tax increases to 15 € per kilo between 1.8 and 1.899 tonnes , € 20 between 1.9 and 1.999 tonnes up to € 30 from 2.1 tones

Allowances on the malus by weight on 1 January 2024:

-

A 100 kg allowance is applied for single hybrids

-

The allowance on legal entities for the purchase of passenger vehicles with at least eight seats is increased from 400 to 500 kilos.

For both the ecological malus and weight-based vehicle malus, starting 01st of January 2024, the amount to be paid has no more cap (being previously capped to 50% of the price of the new vehicle)

Good to know

-

The weight-based vehicle malus will also apply to rechargeable hybrid vehicles (PHEVs), even if their electrical autonomy is greater than 50 km, with effect from 1 January 2025.

-

They will, however, receive an allowance of 200 kilograms, up to a limit of 15% of their own weight, to take account of the weight of the battery.

-

Ecological Bonus – reserved exclusively for specific 100% electric vehicles

Since 16 December 2023, ecological bonuses have been reserved exclusively for electric vehicles with are manufactured respecting specific conditions on environmental impact.

Decree No 2023-930, published in the Official Journal of 8 October 2023, amended the energy code to tighten up the procedures for granting the ecological bonus by requiring compliance with new criteria, for example: the price of the vehicle must not exceed 47.000 €, including the vehicle’s standard equipment but excluding options, and must not exceed 2 400 kg.

The Decree also refers to the Decree of 7 October 2023 which provides that the manufacturer must show an ‘environmental score’ equal to or greater than 60, relating to the conditions in which the car was produced.The decree also provides that the methodology for calculating the environmental score should consider CO2 emissions from materials used in manufacturing (steel, aluminium), energy used in assembly, battery, and transport from the place of production to France.

On 14 December 2023, the government published a list of 56 vehicles eligible for purchase or rental.

A platform provides reliable information on new electric passenger cars and the French government undertakes to update this list every month, if necessary. (https://score-environnemental-bonus.ademe.fr/)

On 13 February, the Decree No 2024-12 is amending the values of the ecological bonus in France.

The ecological bonus is valid only for the purchase of new vehicles, with a price lower than 47.000 € and with a maximum weight of 2400 kg. The vehicle needs to be kept by the beneficiary of the bonus for a minimum of 1 year and must run 6 000 km before being sold.

Also, the amount varies, with the following changes: for a private individual, the bonus decreases from 5.000 € to 4.000 € in 2024 (with the possibility of an additional bonus of 3.000 € for households with lower revenues); while legal entities will not benefit of any ecological bonus starting 2024.

When it comes to LCVs, the vehicles eligible are 100% BEVs and fuel-cell hydrogen, with no price or weight limit, but need to be retained for at least two years. The bonus for private individuals also decreases for private individuals with 1.000 € (from 4.000 € to 3.000 €)

-

Annual CO2 tax

The thresholds for the annual tax on CO2 emissions changed on 1 January 2024.

So far, models certified at less than 20 g CO2/km have been spared. With the lowering of the 5g/km threshold, corporate vehicles are affected as early as 15g/km.

In the case of rechargeable hybrid vehicles (PHEVs), they are still exempted to the extent of 60 g CO2 under WLTP Art.L421-125. This exemption will end for PHEV in 2025.

-

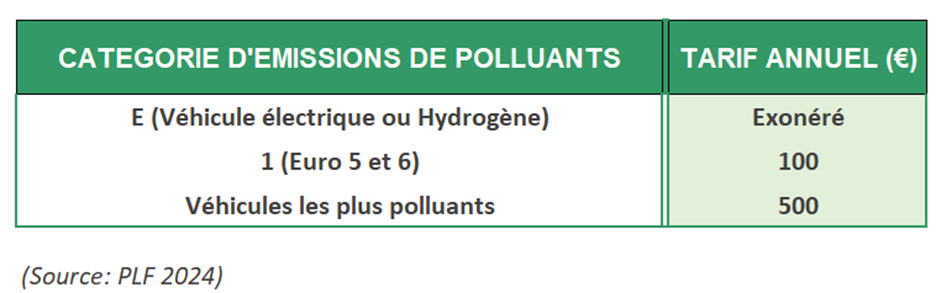

Annual tax on air pollutants emissions

The annual “vehicle age” tax is replaced by a tax on air pollutants emissions (€ 0, 100 or 500).

The annual rate is based on whether the vehicle belongs to one of the following three categories of pollutant emissions:

The full article is available here in French: La Fiscalité en 2024 | mobility-observatory.arval.fr

-

-

GERMANY

-

Financial support for electric vehicles

In 2024, there will be no financial support for electric vehicles at purchase. Consequently, vehicle manufacturers are reacting with rebates equal to the subsidy.

-

Company car in payroll / benefit in kind

From 01.01.2024, the gross list price limit for the 0.25% method should be increased to 80.000 € for electric vehicles that are purchased new or used under the Growth Opportunities Act. Neither this request nor the correction to 70. 000 € has yet been approved. Due to the ongoing legislative process, there may be a change in 2024. Until then, the gross list price limit of 60. 000 € will continue to apply. (Source: Haufe)

-

THG quota

As part of the German government's climate protection measure to regulate the CO2 balance, the greenhouse gas reduction quota (THG quota) was introduced.

In 2022, commercial and private owners of battery electric vehicles could earn up to 400 € annually to sell the THG quota. The value of the THG quota has already fallen by about 200 € in 2023. A further decline in the THG quota for battery electric vehicles is also expected in 2024.

-

Black box for vehicles

By the middle of the year, all newly registered vehicles in categories M1 and N1 (passenger cars and commercial vehicles up to 3.5 t) must be equipped with the "Event Data Recorder." This stores information on speed, ABS data, or the course of the accident, which, except the latter, is deleted after a few seconds.

-

Fuel costs are rising

As a result of the budget crisis, the CO2 tax on fuel will be raised to 45 € per ton. This will directly impact all fleet operators, as fuel costs will be significantly higher. Comparison between 2023 and 2024: CO2 price for a liter of petrol by approx. 4,3 cents and for a liter of diesel by approx. 4,7 cents. (Source: ADAC)

-

Truck toll

From 01.07.2024, vans and motorhomes that are not used commercially but have a total weight of more than 3.5 tonnes will be subject to tolls. Among other things, craftsmen's vehicles under 7.5 tonnes and motorhomes used privately are unaffected.

-

Vignettes

International journeys to Switzerland and Austria will become more expensive due to the increase in the price of vignettes. A new feature for the trip to Austria is the one-day vignette, now available. In addition, there is also a vignette for ten days, two months, and a whole year. To travel to Switzerland, an annual vignette is required.

-

Driver's license mandatory exchange

Old paper car driving licenses must be exchanged for a new, forgery-proof EU driving license in credit card format by 19 January 2024 for car drivers born between 1965 and 1970.

From 20 January 2024, all motorists born after 1971 who obtained their license before 1999 will have to exchange this old license for a new one.

-

New assistance systems are mandatory

As part of EU Regulation 2019/2144, specific assistance systems must be mandatory for all new registrations from 7 July 2024. In addition to the so-called

- black box,

- an automatic emergency braking assistant,

- an emergency lane departure warning system,

- a warning system in the event of drowsiness and loss of attention on the part of the driver,

- intelligent speed assist,

- reversing assistant, and

- collision warning,

- an emergency brake light and

- an extended head impact protection areamust be installed as standard. These systems are intended to contribute to accident prevention and road safety.

In addition, from 7 July 2024, all newly registered trailers with a maximum permissible mass of more than 3.5 tonnes and all commercial vehicles and buses must have a precise tire pressure monitoring system.

-

-

GREECE

The Governmental subsidy on EVs’ registration (up to 8 000 €) and for Chargers (500 €) officially ends in April 2024, but in the meantime the funds available in budget have been exhausted, so new applications for subsidy are handled with delay.

The government has announced its intention to continue the program also in 2024, but with adjustments. However, nothing has been officially published yet. The new law is expected to reach the parliament sometime in May-June.

Concerning taxes, EVs are excluded from road tax, and have no “benefit in kind” taxation, if their retail price before taxes is up to 40,000 €.

On the other hand, the new legislation imposing 1 out of 4 vehicles registered in 2024 in fleets has to be BEV or PHEV is in force.

VAT on public chargers has been reduced from 24% to 6%.

-

ITALY

The eco-incentive scheme provided by the Italian government for 2024 carries on along the route traced in previous years, confirming the objective of renewing Italy's vehicle fleet (one of the oldest in Europe) and accelerating the energy transition also thanks to a support the demand of people with lower incomes.

The deployment will be expected by the end of March (even if timing is affected by the government's implementation aspects) and total funds amount to over EUR 950 million:

-

793 million € for PCs

-

53 million € for LCVs

-

50 million € for “social leasing” offer* (i.e. an expected subsidy dedicated to individuals who subscribed a minimum 3 years long-term rental contract for one vehicles eligible for the eco-bonus, with the goal of making the monthly fee more affordable).

-

55 million € for other vehicles (e.g.bike, motorbike, used cars… )

*This fund will be regulated separately with dedicated document drawn up by the government

Compared to the past, the incentives dedicating a significant share of funds also to full hybrid, mild hybrid and fuel-efficient petrol or LPG vehicles:

CO2 emissions

0-20g/km

21-60g/km

61-135g/km

Max list price (incl. accessories and VAT)

42.700 €

54.900 €

42.700 €

Total allocated fund for PC (793 mio€)

240 million €

150 million €

403 million €

With scrapping Euro 0-1-2

11.000 €

8.000 €

3.000 €

With scrapping Euro 3

10.000 €

6.000 €

2.000 €

With scrapping Euro 4

9.000 €

5.500 €

1.500 €

Without scrapping

6.000 €

4.000 €

–

With scrapping Euro 0-1-2 and ISEE* <30.000€

13.750 €

10.000 €

3.000 €

With scrapping Euro 3 and ISEE* <30.000€

12.500 €

7.500 €

2.000 €

With scrapping Euro 4 and ISEE* <30.000€

11.250 €

6.875 €

1.500 €

With scrapping Euro 5 and ISEE* <30.000€

8.000 €

5.000 €

–

Without scrapping and ISEE* <30.000€

7.500 €

5.000 €

–

Source: sicurauto.it, ilsole24ore.com

*ISEE = an indicator measuring the economic condition of Italian families; it takes into account the income, assets and characteristics of a family unit (in terms of size and type).

For 2024, the Eco-bonus incentive scheme for BEV and Plug-In cars is also extended to companies - including rental companies but excluding car dealers- as long as they keep ownership of the car purchased with 2024 funds (12 months for individuals, 24 for companies).

-

-

NETHERLANDS

-

BPM tax

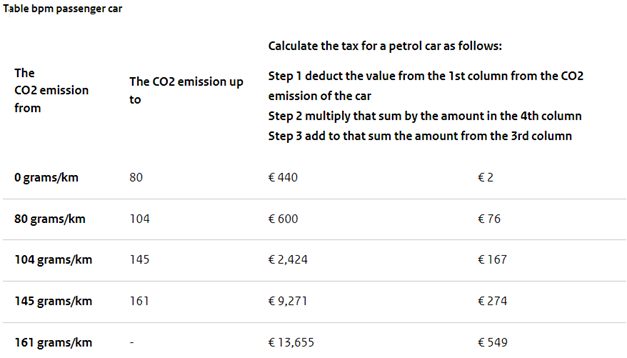

BPM is the private motor vehicle and motorcycle tax. Do you buy a passenger car, motorcycle, or delivery van in the Netherlands? Or do you bring a passenger car, motorcycle, or delivery van to the Netherlands from abroad? In that case you pay levies including BPM. In the text, motor vehicles are understood to refer to either motorcycles or passenger cars. Other rules apply to delivery vans.

Combustion engine

Is the CO2 emission of your passenger car with a diesel engine more than 71 gr/km? Then in addition to the outcome of the table above, you will pay a diesel surcharge of € 106.07 per gram of CO2 emissions above 71 g/km.

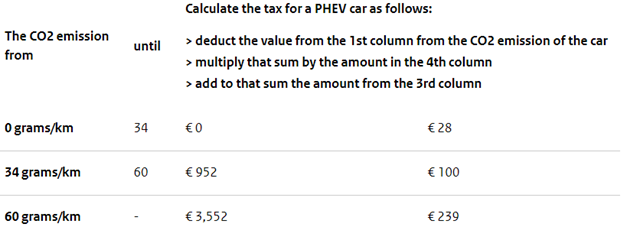

PHEV’s

PHEV means: plug-in hybrid electric vehicle. In addition to an electric motor that can be charged by an external source, the vehicle also has a combustion engine. These motor vehicles have their own bpm rate.

Use the following table to determine the bpm that you must pay for your PHEV passenger car.

The calculation is the same as with a non-PHEV passenger car.

If the combustion engine is a diesel engine, the diesel surcharge also applies here.

For fully electric cars, the BPM tax exemption will continue to exist until end 2024.

-

BIK tax

If the private use of the company car exceeds 500km a year, 22% of the vehicle’s catalogue value will be considered part of the driver’s/user’s income. There is a discount on this standard 22% rate for fuel efficient cars: instead of 22%, a 16% car benefit charge is levied if the car is not emitting CO2 (zero emissions vehicle). The discount rate of 16% only applies to the first 30.000 € of the catalogue price. For an amount above 30.000 €, the regular 22% applies. This threshold does not apply to hydrogen cars. If the private use of a company car is less than 500 km a year, no car benefit is charged. Vehicles keep the tariff for a period that is the same as the standard lease period (calculated from the moment the vehicle is registered for the first time). The Ministry of Finance has set the standard lease period to 60 months.

Individuals with a BEV have a lower percentage of the list price added to their income when using their company car for personal use. For petrol cars, this is 22%. For BEVs, it increased from 4% in 2019, to 16% in 2022 and to 17% in 2025.

-

Untaxed allowances

The untaxed homework allowance will be €2.35 by 2024. From January the 1st 2024, the tax-free mileage allowance for travel expenses was increased from 0.21 € to 0.23 € per kilometer.

-

-

NORWAY

-

Benefit in kind taxation in 2024

The benefit subject to withholding tax related to private use of company car is calculated at: 30 percent of the car's purchase price (including winter tires and other equipment, but no discount and freight cost) up to 351.700 NOK (30.873 EUR), and 20 percent of any excess list price. The rates for the benefit subject to withholding tax apply accordingly when assessed as a taxable benefit.

In cases of a company car scheme for part of the income year, the benefit taxation will be proportional to the number of whole and commenced months during which the car was available.

The basis for the calculation is normally 100 percent of the car's list price as new, with some exceptions. The exceptions apply to both electric and fossil-fuel vehicles.

Exceptions:

Calculation is based on:

If the car is older than 3 years

as of 1 January of the income year

75 percent

of the vehicle's list price as new

If you can document that car is used for work exceeding 40.000 km in the income year

75 percent

of the vehicle's list price as new

In cases of combining:

-

A car older than 3 years as of 1 January of the income year, and

-

work related driving that exceeds 40,000 km in the income year

56,25 percent

of the vehicle's list price as new

Example of calculation of benefit in kind of PC

Example of calculation of benefit in kind of Tesla Model Y Long Range, registered in 2023, with curb weight of 2003 kg and list price (importer's price) of 560.000 NOK + additional equipment (indicative prices excl. shipping) of 40.000 NOK, which equals to a purchase price of NOK 600. 000 NOK, and no exemption benefits:

PC: Tesla Model Y

Amount

Tax base: (560.000 + additional equipment =) 600.000 + (VAT: 25% of 100.000 =) 25.000 + (Weight tax: 2003 kg – 500 kg = 1503 x 12.50 =) 18.787,50

NOK 643.788

EUR 60.503

Surcharge on income (salary before tax) 30% of sum up to 351.700

NOK 105.510

EUR 9.258

20% of the excess amount: 292.088 (643.788 – 351.700)

NOK 58.418

EUR 5.126

Total surcharge on income before tax per year:

NOK 163.928

EUR 14.384

Total surcharge on income before tax per month:

NOK 13.661

EUR 1.199

If the car is older than 3 years or can document work related driving that exceeds 40,000 km in the income year, the car's list price is calculated as 75% of the car's original purchase price:

PC: Tesla Model Y

Amount

Tax base: 75% of original list price + additional equipment (600.000 NOK)

NOK 450.000

EUR 42.291

Surcharge on income (salary before tax) 30% of sum up to 351.700

NOK 105.510

EUR 9.258

20% of the excess amount: 98.300 (450.000 – 351.700)

NOK 19.660

EUR 1.725

Total surcharge on income before tax per year:

NOK 125.170

EUR 10.983

Total surcharge on income before tax per month:

NOK 10.431

EUR 915

-

Benefit in kind for the use of LCV

If you have used your employer's LCVs for private travel, special rules apply for calculating the benefit. In this context, commercial vehicles mean vans class 2 and trucks with a total weight of less than 7.501 kg.

There are two different options for calculating the tax benefit of the private use of a commercial vehicle:

• The standard method: Tax based on the car's list price (with a base deduction from the list price)

• Kilometer rate: Taxes based on private use. Determined with an electronic vehicle logbook administered by the employer.

-

The standard method

The minimum deduction takes account of the fact that commercial vehicles are less suitable for private use than ordinary company vehicles. The list price is reduced by 50 percent, but a maximum amount of up to NOK 150.000 (EUR 14.097).

Example: The commercial vehicle's new car price is NOK 350.000:

VAN CLASS 2

Amount

Tax base:

350.000 - 50%, but max 150.000 = NOK 200.000 (EUR 18.796)

30% of 200.000 (350.000 – 150.000)

NOK 60.000 (EUR 5.638)

20% of 0

0

Benefit taxation amount:

NOK 60,000 (EUR 5.638)

No reduction is given for work related driving over 40.000 km in addition to the minimum deduction.

-

Kilometer rate

For 2024, the rate for calculating the private benefit (based on actual use) is NOK 3,50 (EUR 0,31) per km regardless of mileage.

-

Plug-in hybrids are getting more expensive

The government is making new plug-in hybrids more expensive by removing the deduction they have had in the weight deduction in the one-off fee. The one-off fee for both petrol and diesel cars and plug-in hybrids will go up in 2024. Plug-in hybrids get an average of almost NOK 50.000 (EUR 4.387) more in one-off fee, while new petrol and diesel cars get NOK 17.000 (EUR 1.492) in increased tax compared to 2023.

-

-

POLAND

The new year did not bring any major changes in the regulations governing the functioning of the broadly understood automotive industry in Poland.

-

Registration tax benefits

Electric and plug‐in electric vehicles that are up to 2,000 cc are exempt from registration tax until 2029.

-

Ownership tax benefits

Depreciation:

- up to PLN 225,000 for BEVs and FCEVs

- up to PLN 150,000 for vehicles emitting 0-50g CO2/km

- up to PLN 100,000 for vehicles emitting > 50g CO2/km-

Purchase subsidies

Polish government allocated a total of nearly PLN 400 million (ca. 80 million €) to co-financing the purchase of electric vehicles for companies and local government units. According to the information provided at the beginning of August last year - NFOŚiGW made a decision to allocate another tranche of PLN 100 million, this is dictated by the huge interest in purchase subsidies. Therefore, it can be assumed that the abovementioned total pool of funds will be exhausted in a much shorter period of time than originally assumed.

-

Other taxation changes

On January 1, 2024, the two-year period of suspension of the application of the minimum income tax regulations ended. This means that taxpayers will have to settle the new tax in 2025. The minimum income tax applies to companies if they have their registered office or management board in the territory of the Republic of Poland and tax capital groups that in the tax year: incurred a loss from a source of income other than capital gains or achieved a share of income from a source of income other than capital gains in the income of other than from capital gains of no more than 2%. The tax rate will be 10%. tax bases. The Act does not provide for the criterion of the entity's turnover amount.

The biggest change in tax regulations (and it seems to be the most important, because it will affect all entrepreneurs) is the mandatory issuing of invoices in the National e-Invoice System - KSeF from July 1, 2024. It will not be possible to issue invoices in paper or electronic form in their current form. The purpose of this solution is to provide tax authorities with direct access to issued invoices. Dealers and other entrepreneurs should check whether they have IT programs that will be adapted to these changes.

-

-

ROMANIA

-

Urban Mobility Legislation

In present the urban mobility law Leg. 155/2023 is establishing the general overview for Romania’s national view on handling and promoting urban mobility

The purpose is to establish the necessary conditions for a sustainable, fair, efficient and inclusive mobility system that will achieve better conditions of mobility in urban and rural areas, to reduce greenhouse gases from urban transport and to enhance safety.

Sustainable urban mobility is the area which provides the strategic and operational framework for the correlation between urban planning and development and the transport of persons and goods at the district, city and metropolitan territory level.

Sustainable urban mobility shall be based on the following principles:

-

planning cities for people.

-

the involvement of citizens and other stakeholders.

-

coordination and collaboration between local and central public administrations.

-

planning from metropolitan territory to district level.

-

developing public transport-oriented procedures against urban density.

-

encouraging the use of alternative transport despite use of personal motor vehicles.

-

ensuring access to the public transport services of all citizens, including the fitting of all modes of transport in a functional and inclusive manner, in accordance with the needs of different road users.

-

developing all modes of transport in a fair, integrated and interoperable manner, with a focus on clean transport modes.

-

parking, parking and traffic access control in relation to public transport and non-motorized transport.

-

the use of intelligent transport systems for mobility management, including traffic management, parking and public transport.

-

freight transport management.

Romania’s sustainable urban mobility strategy is maintained until 20/09/2024 with program modification starting from 24/03/2023.

-

Eco-ticket and Eco-Bonus

The modifications made by the current version of the program relate to the amount of Eco-Ticket and to the bonus (eco-bonus) granted for the scrapping of vehicles at least 15 years from the date of manufacture and/or norm of pollution under Euro 3.

The value of the Eco-Ticket for new acquisition of BEV vehicle is different and depends on the number of old vehicles send for ravage.

-

51 000 lei (10 409 €) for the purchase of a pure electric new motor vehicle or a new hydrogen fuel cell motor, except motorcycle, in exchange for one old vehicle send for ravage

-

54 000 lei (11 020 €) for the purchase of a pure electric new motor vehicle or of a new hydrogen fuel cell motor, except motorcycle, in exchange of two old vehicles send for ravage.

The value of the financing cannot exceed 50% of the vehicle retail price and the price of the HBEV or BEV vehicle cannot exceed 75.000 € with VAT included.

Companies can benefit of Eco-Ticket if they are fulfilling the following conditions:

-

It has received form the Administration of Environment Fond (AFM) approval for file

-

It has registered to a valid manufacturer for acquiring a new vehicle and has obtained the registration note and the financing contract.

-

It has handed over the used vehicle to an authorized collector, according to the present Guide.

-

It has radiated from the record the used vehicle movement, according to the present of Guide.

-

It has submitted to the manufacturer information on the destruction and removal from the record of the circulation of the used vehicle, as required by the present Guide.

-

Purchases new vehicle from the validated manufacturer who issued the registration note.

The maximum threshold for a legal person is 200.000 € / 3 years.

Public authorities sustain legislation in taxation regarding electric vehicles as BEV’s are fully exempted from taxations and HBEV’s have are 50% exempted.

Public institutions benefit as well of eco-ticket in different conditions as they are not obligated to handover old vehicle and the value of the Eco-Ticket is up 120.000 lei (24.489 €)

-

-

SPAIN

-

Government subsidies linked to EVs (BEVs and PHEVs)

After the Moves II Plan, the Spanish Government has already updated the third edition of the program for the purchase of electric vehicles and the installation of their charging points: the so-called Moves III Plan, which was originally extended until the end of 2023. The MOVES III cover up to Up to 800 million € in direct subsidy for the purchase of an electric car, up to 9.000 € per vehicle, and the installation of charging equipment. The MOVES III has been extended until July 2024.

These grants are obtained through the dealers. They will directly contribute 1.000 € of subsidy from the invoice. Meanwhile, the subsidy from the Autonomous Community will be paid in the following 12 months.

However, the lack of a common requesting method and the excess of bureaucracy and response times, have resulted in a bit of a minor failure of the plan itself

-

Mobility legislation

Once the Spanish Sustainable Mobility Law goes into full effect, companies with more than 500 employees will have to develop a Mobility Plan which fosters electric, alternative, and shared mobility options. The Law will start its legislative process on February 2024 and is set to be effective before the end of the year.

-

Changes in taxation and Benefit in Kind calculation

Vehicle registration: Taxpayers may deduct 15% of the amounts paid from 30 June 2023 to 31 December 2024, for the installation during that period in a property owned by them of battery recharging systems for electric vehicles that are not used for an economic activity.

The maximum annual base of this deduction will be 4.000 € per year and will be made up of the amounts paid, by credit or debit card, bank transfer, nominative cheque, or deposit in accounts in credit institutions, to the persons or entities that carry out the installation, deducting any amounts that, where applicable, have been subsidized through a public aid program.

Additionally, the exemption from ‘special tax’ for vehicles emitting up to 120g CO2/km is still in force.

Ownership: Depending on local measures, EVs get an exemption from or a reduction of road tax.

Road tax exemption / reduction depending on local policies, e.g., in place for Madrid, Barcelona, Zaragoza, Valencia

Reduction of 75% for BEVs in main cities (e.g., Madrid, Barcelona, Zaragoza, Valencia, etc.).

VAT: No incentives available regarding VAT, exempt Canary Islands: IGIC (Canary Islands VAT) exemption for alternative‐powered vehicles (ie BEVs, FCEVs, PHEVs, EREVs, HEVs, CNG, LPG) emitting up to 110g CO2/km

IRPF: Personal income tax deduction for the purchase of plug-in electric and fuel cell vehicles and recharging points. You can apply the deduction for the purchase of a single new electric vehicle if it is for your own private use. The basis for the deduction is the acquisition value of the vehicle, including the expenses and taxes inherent to the acquisition, and the amounts subsidized or to be subsidized through a public aid program shall not form part of the deduction.

In any case, the deduction base may not exceed 20.000 €.

-

Additional legislation changes that can impact fleet, companies having fleets, and mobility

EVs are exempt from tolls on certain regional highways, may use High-Occupancy Vehicle lanes, in some cases, and get free parking in some city areas.

Infrastructure subsidies (Subsidies for private and public charging points.) are included in Plan Moves III

Toll exemption on regional highways for electric vehicles. Free parking in selected cities. Traffic lanes reserved for high occupancy circulation can be used only by the driver of BEV's.

According to the Law 29/2021, nonresidential buildings (companies) with more than 40 parking places, and also all new construction buildings, will need to install charging points.

According to the Law 7/2021, selected service stations will need to install fast or super-fast charging points (according to sales volume criteria)

With the upcoming European Union Corporate Sustainability Reporting Directive (CSRD), greenhouse gas reporting will soon be mandatory for several companies (starting with those with more than 500 employees under public interest). Mobility and fleet managers are faced with the double challenge of figuring out how to concretely reduce employee mobility, find ways to accurately report their fleet emissions and measure their employees' commuting footprint. The fleet’s carbon footprint will need to be accordingly distributed among scope 1 (ICEs professional use), 2 (EVs), 3 (commuting).

In the Balearic Islands, according to the Law 10/2019, companies that are planning to renew its fleet must include a minimum % of electrified vehicles.

-

-

SWEDEN

No BIK taxation rule changes vs 2023. The calculation remains the same but two components of the calculation will increase,

-

Prisbasbeloppet will increase by 4.800 SEK which effect the annual BIK value by 1.392 SEK

-

The interest (statslåneräntan +1%) will increase by 0,479% which effect the annual BIK by 1. 523 SEK

Total effect per month on the BIK value is 273 SEK.

For electric Light Commercial Vehicles a new temporary environmental support from the Government will be introduced from February 13, 2024. A buyer of an e-LCV will receive a support up to max 50. 000 SEK.

The support will gradually be decreased to stop at the end of 2025.

Diesel and petrol cost. The reduction obligation, the amount of fossil free fluid that must be blended into the diesel and petrol was in 2023 7,8% for petrol and 30,5% for diesel.

-

In 2024 the required reduction obligation is reducing to 6% for both petrol and diesel.

-

The theoretical effect is expected to be 4.0 SEK per liter diesel and 0.30 SEK per liter for Petrol.

-

-

SWITZERLAND

Even though the changes for 2024 are limited, there is one important change with relevant impact in terms of tax on imports for BEV’s

-

Electric cars in Switzerland were previously exempt from the one-off automobile tax on imports, but this is now set to change. With the abolition of the tax exemption on January 1, 2024, e-cars in our neighboring country will in future be subject to the normal tax rate of four percent for cars used to transport people or goods. A good time for a brief review of the supporting measure.

-

The BIK calculation remains unchanged at 0.9% per month or 10.8% per year of the net investment value of the corresponding vehicle. As before, no distinction is made between combustion vehicles and electric cars.

-

VAT increase in Switzerland in 2024 From 01.01.2024, an increase in value added tax (VAT) will come into force in Switzerland. The standard rate will increase from 7.7% to 8.1%, the reduced rate will be 2.6% from January instead of 2.5% and the special rate for accommodation will be 3.8% instead of 3.7%

-

-

UK

-

Company car tax bands: 2022 - 2028

The table below shows future BIK tax bands (also known as company car tax) based on CO2 emissions of a vehicle.

A company car benefit is calculated by multiplying the car's list price (including selected optional accessories) by the relevant percentage graduated according to the CO2 emissions. The relevant percentages of list price has been announced until the 2027/28 tax year

Diesel Supplement: An additional 4% supplement is added to the '% list of price' if the car runs solely on diesel (up to the limit of 37%). The supplement is not added if the car is also certified to the Real Driving Emissions Step 2 (RDE2) standard.

-

Car Fuel Benefit Charge

The government will maintain the Van Benefit Charge and the Car & Van Fuel Benefit Charges at 2023-24 levels for 2024-25.

For tax year 2024/25 the benefit in kind calculation = £27,800 x ‘% of list price’

NB: '% of list price' is the same as that used for calculating the company car benefit in kind (see above).

The diesel supplement is also applicable.

The car fuel benefit charge does not apply to electric only cars.

-

Company Van Benefit

Vans (CO2 emissions greater than zero)

The government will maintain the Van Benefit Charge at 2023-24 levels for 2024-25.

2023/24 2024/25

Van benefit charge £3,960 £3,960

Van benefit reduced to nil if there is only insignificant private use (commuting is not deemed to be private use in a van, provided that the primary reason that the employee has use of the van is for business travel in the normal course of their job) or it is a pooled van.

Vans (zero CO2 emissions)

The van benefit charge for a zero CO2 emission van will be a percentage of the full van benefit, as follows:

2022/23 2023/24

Percentage of van benefit 0% 0%

-

Van Fuel Benefit

The government will maintain the Van Fuel Benefit Charge at 2023-24 levels for 2024-25.

2023/24 2024/25

Van fuel benefit charge £757 £757

Van fuel benefit charge reduced to nil if the employee is required to make good the full cost of all private fuel (and does actually make good), or where the van produces zero CO2 emissions.

-

Vehicle Excise Duty (VED)

The government will uprate VED rates for cars, vans and motorcycles in line with RPI from 1 April 2024

Electric Cars and Vans

Zero emission cars registered on or after 1 April 2025 will be liable to pay the lowest first year rate of VED (which applies to vehicles with CO2 emissions 1 to 50g/km). From the second year of registration onwards, they will move to the standard rate.

Zero emission cars first registered between 1 April 2017 and 31 March 2025 will also pay the standard rate from 1 April 2025 onwards.

The Expensive Car Supplement exemption for electric vehicles is due to end on 31 March 2025.

Zero emission vans will move to the rate for petrol and diesel light goods vehicles, currently £290 a year for most vans.

-