Arval Mobility Observatory is pleased to share with you a synthesis of changes to statutory taxation and the associated mechanisms evolutions in Europe and Latin America, by country.

As follows, you will find a non-exhaustive list highlighting the evolution of governmental taxation, grants and bonus schemes for 2025 in 20 countries (Austria, Belgium, Chile, Czech Republic, Denmark, Finland, France, Germany, Greece, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Romania, Spain, Sweden, Switzerland, UK). You can check each country by selecting it on the list below.

The information presented in this synthesis has been collected in January 2025, and published in February 2025.

Update 28.02.2025: France - change in the Benefit in Kind calculation

-

Austria

Taxation of Vehicles Evolution

In Austria, the taxation landscape for vehicles is expected to undergo several changes in 2025, linked to new government. Notably, the road tax for personal cars and motorcycles will increase by €34.56 per year compared to 2024 if the vehicle is registered from January 1, 2025. However, Battery Electric Vehicles (BEVs) will remain exempt from this tax.

Registration Tax (NoVa)

The CO2 emission limit is reduced every year by 3 grams, with a personal car limit set at 94g and Light Commercial Vehicle (LCV) at 147g. Vehicles emitting below these limits do not incur NoVa. Purchase or leasing contracts signed by December 1, 2024, with delivery by April 1, 2025, will adhere to 2024 CO2 limits.

Benefit in Kind (BIK)

BIK calculations are based on CO2 emissions, vehicle's first registration date, and leasing price. BEVs and vehicles with zero CO2 emissions are exempt from BIK. The employee reimbursement amount for home charging will increase to 35.889 cents/kWh.

New electricity price for private charging and BIK calculations

The reimbursement amount for home charging will be increased to 35.889 cents per kWh. Employees must provide proof that the energy used is for charging the company car, which can be done through the charging station, in-vehicle records, or the operator's app. If this condition is met, the employee will not incur any Benefit in Kind (BIK) for the charging

-

Belgium

Taxation of Vehicles Evolution

Belgium has seen significant changes in the fiscal deductibility of CO2-emitting vehicles purchased from July 1, 2023. These changes will come into full effect in 2025, reducing the maximum fiscal deductibility from 100% to 75% and minimum from 50% to 0%. No grants available anymore, at national or regional level

-

Chile

Taxation of Vehicles Evolution

Chile offers reduced vehicle registration costs and tax exemptions for electric vehicles. E.g., electric buses and trucks may qualify for government support under the Ministry of Energy’s electromobility initiatives, which promote fleet electrification.

Discussions are ongoing to introduce incentives for company-provided EVs, particularly for fleet vehicles. The Green Tax Law imposes higher fees on high-emission vehicles, promoting the transition to electric or hybrid alternatives.

Support for EV Charging Points

Chile provides subsidies for charging infrastructure through the Ministry of Energy or private companies, encouraging installation in commercial and residential locations for the benefit of employees and customers.

-

Czech Republic

Taxation of Vehicles Evolution

Currently, no subsidies for BEVs or PHEVs are available, and no changes in taxation or BIK calculations are expected in 2025. The highway vignette price will increase for Internal Combustion Engine (ICE) vehicles to 2,440 CZK (97 EUR), with PHEVs at 610 CZK (24 EUR), and BEVs and FCEVs remaining free.

Support for EV Charging Points

Private individuals can obtain a subsidy for an AC wall box if combined with major household renovations. No subsidies are available for company charge points.

-

Denmark

Taxation of Vehicles Evolution

From 2025, Denmark will implement new regulations affecting company car taxation and vehicle registration tax. The taxation of company cars (“værdi af fri bil”) will be adjusted to account for their environmental impact, with lower taxes for less polluting vehicles. The registration tax will similarly be tied to the vehicle’s environmental performance, promoting the adoption of Battery Electric Vehicles (BEVs).

Benefit in Kind Taxation

Benefit in Kind (BIK) calculation is slightly changes from 2024 as there is no longer a split of percentages up to the threshold of below and above DKK 300.000. From 2025 the taxation is 22,5% of the car price.

The environmental fee added factor multiplied with the green owner tax moves from 600% in 2024 to 700% in 2025.

-

Finland

Benefit in Kind Taxation

Benefit in Kind taxation in Finland for 2025 is categorized by the vehicle's registration year. Taxable values are based on the replacement price of the vehicle and can include home charging solutions for BEVs and PHEVs. The Finnish government supports electrification with tax deductions for zero and low-emission company cars, valid until 2029.

Replacement price is the general recommended retail price of the specific make and model. The amount is quoted at the date of purchase by the importer minus 3400 €. All extra accessories which exceed 1200 €, including additional home charger for PHEV or BEV, are included in the valuation. Home charger can be added as one of extra accessories starting from 2023. Winter tyres are excluded here as the winter tyres are mandatory in Finland.

Car benefits are divided into two types: unlimited and limited benefit. Unlimited benefit includes all costs regarding usage of the car, fuel and/or electricity as well. Limited benefit includes other car-related costs than fuel and/or electricity.

Age group A (registration years 2023-2025)

- Unlimited benefit: The monthly tax value 1,5 % percent of the replacement price of the vehicle + 285 €

- Limited benefit: The monthly tax value 1,5 % percent of the replacement price of the vehicle + 105 €

Age group B (registration years 2020-2022)

- Unlimited benefit: The monthly tax value 1,2 % percent of the replacement price of the vehicle + 300 €

- Limited benefit: The monthly tax value 1,2 % percent of the replacement price of the vehicle + 120 €

Age group C (registration before 2020)

- Unlimited benefit: The monthly tax value 0,9 % percent of the replacement price of the vehicle + 315 €

- Limited benefit: The monthly tax value 0,9 % percent of the replacement price of the vehicle + 135 €

-

France

The Finance Law for 2025 was published in the Official Journal on Saturday, February 15. The tax measures concerning automotive fleets are now in effect. Two main observations emerge from these changes: vehicles deemed polluting are taxed more heavily (both at acquisition and during regular use), and the transition to vehicles considered virtuous no longer benefits from the same financial support as before (notably with the removal of the conversion bonus and the significant reduction of the ecological bonus). The year 2025 thus continues a trend that has been ongoing for several years.

Below you will find a summary of all the changes. For further information and details, you can check the dedicated Arval Mobility Observatory France article on this topic.

Annual Taxes on Passenger Vehicles (TVU)

France has removed the exemption from annual CO2 emissions tax for hybrid vehicles since January 1, 2025. New progressive scales for annual CO2 emissions tax have been introduced.

Registration Taxes

Regional Tax Increase: The regional tax has increased in almost all regions, with specific rates and exemptions for "clean" vehicles.

CO2 Penalty

Increased Rates: From March 1, 2025, the CO2 penalty rates have been increased, with a lower threshold for triggering the penalty and higher maximum amounts.

Ecological Bonus

New vans are excluded from the ecological bonus since December 2, 2024.

The ecological bonus has significantly decreased, with a maximum budget envelope of 690 million euros for 2025

Fleet Greening Tax

A new tax on fleet greening has been introduced. Companies not electrifying their fleets quickly enough will incur a tax starting at 2,000 euros per vehicle in 2025.

Conversion Bonus

The conversion bonus has been removed since December 2, 2024, affecting all previously eligible new vehicles.

Retrofit Bonus

Updated income thresholds for the retrofit bonus, with specific amounts for different vehicle types

Low Emission Zones (ZFE-m)

New restrictions in "ZFE territories" and "vigilance territories" starting January 1, 2025.

Vehicle Benefit in Kind

(Update done on 28.02.2025)

The rules on calculating benefits in kind related to company vehicles have been profoundly modified by the decree of February 25, 2025, published in the Official Journal on February 27, 2025. Both thermal vehicles and fully electric vehicles are concerned, with retroactive effect from February 1, 2025. The decree also specifies the rules regarding benefits in kind for electric charging stations.

- In other words, for vehicles made available up to January 31, 2025, there is no change in the rules for calculating benefits in kind.

- For vehicles made available (delivery date counts) from February 1, 2025, new rules apply.

- No change in the evaluation method: Companies still have the choice between two methods for calculating the vehicle benefits in kind:

- An evaluation based on actual expenses incurred (depreciation, insurance, maintenance, fuel if covered by the employer).

- A flat-rate evaluation expressed as a percentage of the purchase cost or the total annual rental cost.

Benefit in Kind calculation for Thermal Vehicles

When the vehicle is purchased, the evaluation is now based on 15% of the purchase cost (20% if fuel is covered by the employer). If the vehicle is more than 5 years old, the percentages respectively drop to 10% of the purchase cost and 15% if fuel is covered.

When the vehicle is leased, the evaluation is based on 50% of the total annual cost (rental, maintenance, insurance). If fuel is covered, the evaluation rises to 67% of the total cost.

Benefits in Kind calculation for Electric Vehicles

Electric vehicles retain a specific system, but the mechanism is revised by the decree. Between February 1, 2025, and December 31, 2027, fully electric vehicles (provided they have obtained ADEME's eco-score certification) benefit from a 70% reduction on the benefit in kind, up to a limit of 4,582 euros per year.

Benefit in Kind for Electric Charging Stations

The system applies from February 1, 2025, to December 31, 2027.

- If the charging station is installed at the employee's workplace, its use is not considered a benefit in kind. This also applies to electricity costs.

- If the charging station is installed at the employee's home, the regime is different. If the employer partially or fully covers the purchase and installation of a charging station, the benefit in kind is exempted from social contributions up to 1,043.50 euros (1,565.20 euros for a station older than five years).

-

Germany

Starting in 2025, several changes related to vehicle usage and mobility will come into effect in Germany, impacting both private individuals and fleet operators. Below is a detailed summary of the most significant changes

Taxation Changes

From 2025, the tax benefits for fully electric vehicles in Germany will remain, with a taxable base of 0.25% of the gross list price for vehicles priced up to €70,000.

Only PHEVs meeting strict criteria will qualify for tax benefits: A maximum CO₂ emission of 50 grams per kilometre, or a minimum purely electric range of 80 kilometres. Vehicles that do not meet these requirements will be taxed as conventional combustion vehicles, potentially increasing the tax burden for their users.

The current exemption from vehicle tax for battery-electric vehicles applies to first registrations up to December 31, 2025. These vehicles will be exempt from vehicle tax for a period of up to ten years, but no longer than December 31, 2030.

Legislative Changes

Euro 7 emission standards, adopted in 2024, will apply from 2025, aiming to reduce emissions from passenger cars and light commercial vehicles. These standards will apply to: (1) newly approved vehicle types starting in 2025 and (2) all newly registered vehicles starting in 2027.

Stricter CO2 fleet targets will also be enforced from January 1, 2025.

Greenhouse Gas Reduction Quota (GHG Quota)

Several changes to the GHG quota will take effect in 2025:

- The mandatory GHG quota will rise from 9.5% in 2024 to 10.5% in 2025, requiring petroleum companies to further reduce CO₂ emissions or purchase corresponding certificates.

- The emissions factor for the German electricity mix will be set at 124 kg CO₂-equivalent per gigajoule in 2025, compared to 138 kg CO₂-equivalent per gigajoule in 2024. This improvement will increase the calculated CO₂ savings of electric vehicles by approximately 19.36%, potentially leading to higher GHG premiums.

- From 2025 onward, companies may only apply certificates from the respective year, preventing the transfer of previously acquired low-cost certificates. This could increase demand for current certificates, positively affecting GHG premiums.

Toll Regulations for Commercial Vehicles

Through the end of 2025, emissions-free vehicles will remain exempt from tolls. The CO₂ differentiation will continue at the 2024 level.

The numerous changes in the fleet and mobility sector highlight the dynamic development toward sustainable and efficient transportation solutions. However, additional political decisions and adjustments could arise following the federal elections scheduled for February this year, further influencing this transformation.

-

Greece

Government Subsidies

Changes are expected in Greece at the end of Q1 2025 as the governmental subsidy program for EV purchases ends in April 2025.

-

Italy

Government Subsidies

The Italian government allocated 400 million euros over 2026 and 2027 for the automotive industry. These funds aim to safeguard industry competitiveness domestically and internationally rather than directly incentivize vehicle purchases.

Fringe Benefit Taxation

From January 1, 2025, the taxation on company cars will be based on the vehicle's power supply, with new percentages for electric, plug-in hybrid, and other vehicles, leading to increased taxation for ICE and full hybrid vehicles.

For the calculation of the benefit for new registrations with a contract subscribed from 1 January 2025, new percentages will be 10% for electric vehicles, 20% for plug-in hybrids and 50% for the rest of the cars. These percentages will apply to the lump sum determined through the cost per kilometre based on ACI data, with a conventional annual mileage of 15,000 km. For these reasons, an expected increase in taxation is likely for ICE and full hybrid vehicles, while electric cars lower their costs by easily falling within the fringe benefit exemption threshold.

2024

2025

CO2 emissions: up to 0-60 gr/km: 25%

Full electric (BEV): 10%

CO2 emissions: 61-160 gr/km: 30%

Plug-In hybrid (PHEV): 20%

CO2 emissions: 161 a 190 gr/km: 50%

ICE, MHEV, FHEV, LPG/CNG cars: 50%

CO2 emissions: over 191 gr/km: 60%

Source: quattroruote.it

-

Luxembourg

Benefit in Kind (BIK)

The current tax regime for electric company cars has been extended by two years until the end of 2026.

The benefit in kind for 100% electric company cars will remain unchanged until the end of 2026

- 0,5% for 100% electric vehicles with consumption ≤ 18kWh/100 km

- 0,6% for 100% electric vehicles with consumption > 18kWh/100 km

However, the benefit in kind will change from 1 January 2025 to 2% for combustion engine, hybrid and plug-in-hybrid engines.

-

Netherlands

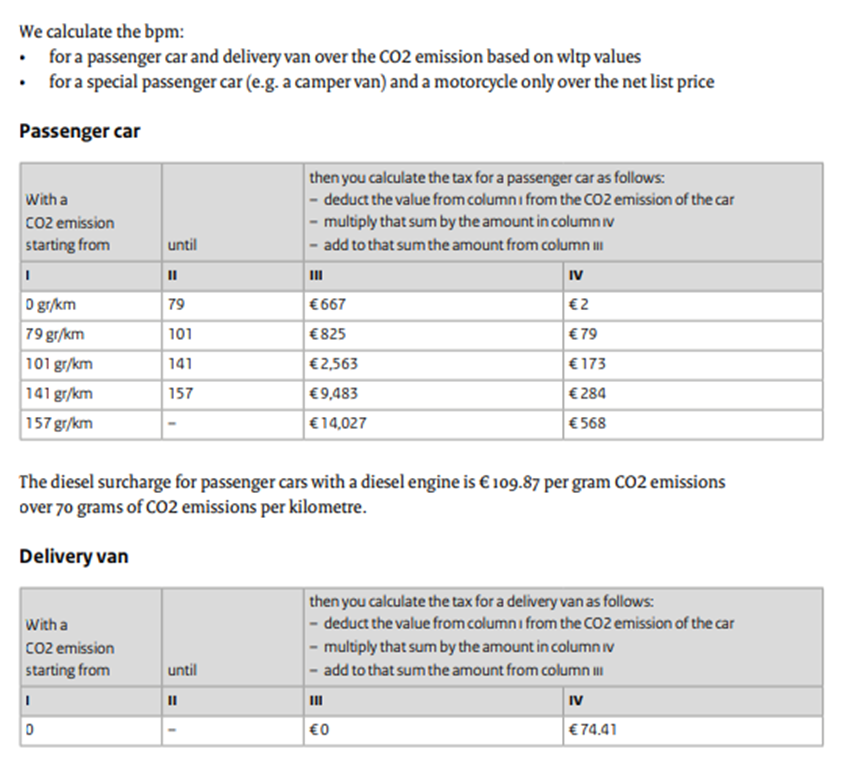

BPM Tax

The BPM tax applies to passenger cars, motorcycles, and delivery vans, with specific rules for each type. For passenger cars and delivery vans, the CO2 emissions play a big role in the calculation.

Benefit in Kind

BIK tax for company cars used for private purposes exceeding 500km a year will be 22% of the vehicle's catalogue value, with a discount for zero-emission vehicles. There is a discount on this standard 22% rate for fuel efficient cars: instead of 22%, a 17% car benefit charge is levied if the car is not emitting CO2 (zero emissions vehicle). The discount rate of 17% only applies to the first 30.000 € of the catalogue price. For an amount above 30.000 €, the regular 22% applies. This threshold does not apply to hydrogen cars. If the private use of a company car is less than 500 km a year, no car benefit is charged. Vehicles keep the tariff for a period that is the same as the standard lease period (calculated from the moment the vehicle is registered for the first time). The Ministry of Finance has set the standard lease period to 60 months.

Untaxed Allowances

The untaxed homework allowance will be €2.40 by 2025, and the tax-free mileage allowance for travel expenses increased to 0.23 € per kilometer from January 1, 2024.

-

Norway

Taxation of Vehicles Evolution

Norway will continue VAT exemption on BEV purchases up to NOK 500,000 and a minimum 30% discount on toll roads compared to ICE vehicles. Plug-in hybrids will face increased tax from April 1, 2025 (of more than NOK 45 000 ~ EUR 3 800), potentially phasing out PHEVs in Norway.

Benefit in Kind

The benefit subject to withholding tax related to private use of company car is still calculated at: 30% of the car's purchase price up to a certain amount, which has increased slightly from NOK 351 700 to NOK 362 300.

Other Legislative Changes

New rules for reversal of VAT at the end of the lease period of passenger cars will extend from 4 to 7 years, making leasing more expensive.

-

Poland

Government Subsidies

The "Mój Elektryk" program ended in December 2024 and will be replaced by a new program starting February 2025, offering up to PLN 40,000 in subsidies for new electric car purchases, with a budget of PLN 1.6 billion from the National Recovery and Resilience Plan (KPO). Beneficiaries of the program – individuals, individuals running a sole proprietorship – will be able to receive up to PLN 40,000 in subsidies for the purchase, leasing, or long-term rental of a new electric car. The maximum purchase price of a vehicle eligible for support is PLN 225,000 net (excluding VAT), while in the current program it is PLN 225,000 gross (including VAT).

-

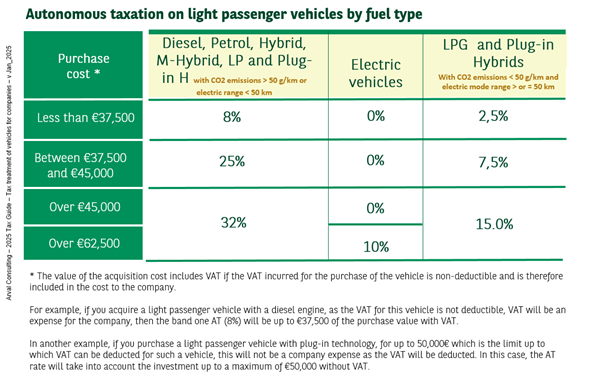

Portugal

Tax Reductions

The Portuguese government has introduced measures in the Government Budget for 2025 with direct impact in vehicle taxation: there is a reduction on the autonomous taxation rates for internal combustion vehicles (diesel and petrol) by 0.5 bps, and the scope of this measures are also applicable for hybrid vehicles without plug-in system and plug-in hybrid vehicles that do not meet the minimum autonomy criteria, in electric mode, of 50 km and less than 50g/km of CO2 emissions.

-

Romania

Government Incentives

Incentives for electric and hybrid vehicles have decreased significantly. The current incentive is 25,500 RON for electric vehicles and 13,000 RON for PHEVs.

-

Spain

Government Subsidies

The MOVES III program has been extended until June 30, 2025, offering up to 9,000€ per vehicle for electric vehicle purchases. The Spanish government is working on a successor programme, that aims to address structural weaknesses of MOVES III, such as lengthy waiting periods for applicants to receive bonuses, which currently can extend up to two years.

Benefit in Kind Calculation

Since 2023, Spain has offered unrestricted and accelerated depreciation tax benefits for investments in assets utilizing renewable energy sources and electric vehicles. The provision of an electric vehicle by the company is considered a benefit in kind, and therefore has tax implications. Fully electric vehicles enjoy a 30% deduction on the valuation of the benefit in kind by the Tax Agency. This tax incentive significantly reduces the impact on payroll.

Support for EV Charging Points

The MOVES III Plan offers financial incentives for the installation of EV charging infrastructure. Companies can receive subsidies covering up to 30% of the eligible costs or installing private charging points intended for their own fleets or employee use.

Additional legislation

The new Sustainable Mobility Law mandates companies with over 500 employees to have a sustainable mobility plan and properly report fleet emissions.

-

Sweden

Government Subsidies

The e-LCV bonus will reduce in stages throughout 2025, eventually ending by October.

- January 1 – reduction of the e-LCV bonus from max 50.000SEK to 40.000SEK

- July 1 – reduction of the e-LCV bonus to 30.000SEK

- October 1 – the e-LCV bonus will finish

Benefit in Kind

The BIK calculation contains various element apart from the vehicle price:

- Interest (stadslåneräntan) will drop from 2,62% to 1.96%. this will have reduced effect on BIK. Example: a car that cost 500.000SEK will have the BIK reduced by 1.875 SEK/year

- Prisbasbeloppet will only have a minor increase. From 57.300 to 58.800. Impact on BIK is +435 SEK/year

Additional legislation

The tax on petrol and diesel will see reductions in January and July, with an increase in the fuel reduction obligation in July.

- January 1 – tax on petrol & diesel fuel is reduced by 0,35 SEK/litre excl. VAT

- July 1 – tax on petrol & diesel fuel is reduced by 0,32 SEK/litre excl. VAT

- July 1 – the fuel reduction obligation will increase from 6% to 10%. This will have a price increase effect.

-

Switzerland

In Switzerland, there are no major impacts due to new regulations or taxes

From March 2025, automated driving is allowed on Swiss motorways if the vehicle is certified.

The government aims to reach 20,000 charging points by the end of 2025.

-

United Kingdom

Zero Emission Vehicle (ZEV) Mandate

The second full year of the ZEV mandate starts in 2025, OEMs facing 28% zero-emission vehicle (battery/fuel cell electric) targets for new cars, and 16% for LCVs with per-vehicle penalties for non-compliance.

Vehicle Excise Duty

For the UK, the Vehicle Excise Duty (VED) changes will affect all cars registered since April 2017, equalising annual VED renewals at £195, plus £425 Expensive Car Supplement for any new registrations priced at £40,000 or more. First-year rates for EVs are set at £10, vehicles emitting 1-75g/km CO2 will increase by £100, while all others will double. Electric van VED will also be equalised with ICE vans at £345.

Double-cab pickup trucks will be treated as cars (instead of being treated as LCVs) for the purposes of corporation tax. This will effectively reduce capital allowances for purchased vehicles from 100% (under the Annual Investment Allowance) to 6% for nearly all of these vehicles.

Charing points subsidies

The grant giving financial support (up to £350) to landlords who are considering buying and installing EV charge points at residential or commercial properties in the UK comes to an end in March 2025

The support for workplaces and educational establishments remains under the Workplace Charging Scheme (WCS)

100% first-year allowance for qualifying expenditure on zero-emission cars and the 100% first-year allowance for qualifying expenditure on plant or machinery for electric vehicle charge-points continues to 31 March 2026 for Corporation Tax purposes and 5 April 2026 for Income Tax purposes

Company Car Tax Rates

From April 2025, company car tax rates will increase for vehicles under 75g/km CO2, with new rates for double-cab pickup trucks and benefit charges adjusting to Consumer Price Index (CPI) inflation. New rates will be £4,020 for vans, £789 for van fuel, £28,200 for car fuel.

London Congestion Charge

The Cleaner Vehicle Discount will be discontinued from December 25, 2025, and BEVs will be charged to enter the zone.

Legal disclaimer

Whilst every care has been taken to ensure the accuracy of this synthesis of changes to statutory taxation and the associated mechanisms evolutions in Europe (the “Synthesis”), , Arval Service Lease, through its Arval Mobility Observatory ( “ARVAL AMO”) does not give any representation or warranty as to the legal, regulatory, tax or accounting implications of the matters referred to in this Synthesis nor for the accuracy of the information provided herein. This Synthesis is provided for information only. Thus, this Synthesis cannot be assimilated as a tax advice /recommendation issued by Arval AMO. Therefore, any recipient of this Synthesis should take independent advice where necessary. In this respect, ARVAL AMO is not responsible or liable for any liability, loss, claim, cost, or expense that could be incurred by any recipient as a result of relying on any information contained in this Synthesis.