ESG (environmental, social, and governance) reporting provides a structured approach for companies to disclose their environmental impact, social contributions, and governance practices.

Being transparent about those three aspects demonstrates accountability and understanding of the impact that large organizations have on both the environment and society. The introduction of new reporting requirements also provides an opportunity to assess the impact of participants within their own value chain. Ultimately, this transparency also helps to build trust with investors, consumers, and stakeholders.

In this article, you’ll find information on how to navigate the key aspects of ESG reporting, including carbon emissions, the Corporate Sustainability Reporting Directive (CSRD), and EU taxonomy. We’ll also provide guidance on how these elements are related to the management of employee mobility and fleets – including those consisting of leased vehicles – and what businesses need to know to stay ahead.

Understanding the key concepts of ESG reporting

ESG reporting enables companies to disclose information about three main components:

- Environmental (E), including pollution, resource use, waste management, greenhouse gas (GHG) emissions, impact on biodiversity, and more

- Social (S), including relationships with and between employees, suppliers, customers, and the communities where they operate

- Governance (G), focusing on governance aspects such as board diversity, executive compensation, and ethics

A company’s impact refers to how its operations, including its entire value chain, affect the environment and society at large in those three categories. Note that while it can negatively impact E, S, or G, companies are increasingly striving for positive impacts.

Financial materiality, another key term related to ESG reporting, focuses on how these impacts affect organizations’ financial performance by potentially increasing costs or financial risk, as well as presenting financial opportunities to enhance revenues or reduce expenses.

Many studies have shown a positive correlation between ESG performance and financial outcomes. For example, research by MSCI suggests that companies with high ESG ratings tend to be more profitable and pay higher dividends. Additionally, a meta-analysis of over 2,000 studies by G. Friede et al. found that a majority reported a positive relationship between ESG and corporate financial performance (CFP).

There’s a strong need for businesses to provide clear, truthful ESG data to stakeholders, governing organizations, and consumers, demonstrating transparency and accountability – and responsible governance and ethical practices.

For ESG reporting to be truly effective, it must be both transparent and accurate, as well as follow standardized guidelines; ultimately, the data's usefulness is reduced if it cannot be compared.

Furthermore, with rising expectations and scrutiny regarding ESG factors, along with the potential for unfounded sustainability claims, having a standardized framework and language enhances such comparability and enforces accountability in organizational ESG statements. It also helps protect companies from legal actions, such as those outlined in the EU Green Claims directive.

For those reasons, several frameworks have been created to enable companies to disclose ESG practices and performance in a way that is consistent, like the Corporate Sustainability Reporting Directive (CSRD), the EU Taxonomy, the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), which all help companies report on their ESG performance effectively. The first two are particularly relevant to companies operating in Europe, so we’ll focus on them below.

Carbon emissions in ESG reporting

Carbon is the most known of several greenhouse gasses that play a key role in climate change, but not the only one; methane is another example. For the sake of simplicity and to allow easier comparisons, other gasses are expressed in Carbon equivalents.

The concept of companies’ (and individuals’) carbon footprint has gained traction in the past years; collecting and sharing accurate information about carbon emissions is a key component of ESG reporting, and this extends beyond the direct impact of a company’s activity.

Many companies today recognize the importance of carbon accountability across the entire lifecycle of their assets. This involves managing emissions beyond the company's direct control, including those from employee commuting, deliveries, and the entire value chain.

For better visibility and reporting, carbon emissions are categorized into three different categories, Scope 1, 2, and 3, as defined by the Greenhouse Gas Protocol (GHG Protocol), a widely recognized international carbon accounting framework:

- Scope 1 emissions are direct greenhouse gas emissions from sources that are owned or controlled by the company, including company-owned vehicles and manufacturing processes

- Scope 2 emissions are indirect emissions from energy consumed by the company

- Scope 3 emissions are indirect emissions across the entire value chain, including business travel and commuting, and emissions from goods and services purchased by the company

Scope 3 emissions are often the largest share of a company’s carbon footprint – up to 70%, according to Deloitte – and can be the most challenging to measure and manage.

The GHG protocol defines guidelines to classify and evaluate companies’ emissions including the ones from companies’ leased vehicles fleets in alignment with their financial statements.

Companies can adopt carbon reduction strategies such as leasing low-emission vehicles (including electric passenger cars and eLCVs), promoting alternative transportation modes and carpooling, and using telematics to monitor vehicle efficiency.

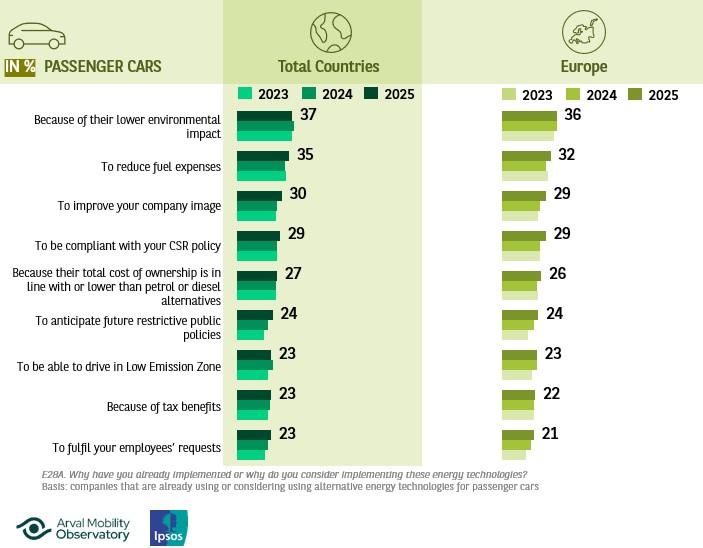

Fleet managers are aware of this; we looked at the key reasons why companies have implemented or are considering implementing alternative energy technologies for their cars, and in the top 3 reasons, we have both their lower environmental impact and the need to be compliant with the organization’s CSR policy (for EU companies, 37% and 29%, respectively):

Reasons why companies have implemented or are considering implementing alternative fuel technologies (Source: The Arval Mobility Observatory Fleet and Mobility Barometer 2025)

EU Taxonomy

The EU Taxonomy is a classification system designed to provide clear criteria for determining whether economic activities are environmentally sustainable and to help guide investors and companies toward supporting the EU’s climate and energy goals.

It aims to direct capital toward activities that contribute to environmental objectives, such as climate change mitigation, climate change adaptation, and the sustainable use and protection of water and marine resources. To achieve this, it applies sector-specific standards, such as Article 6.5 (Transport by motorcycles, passenger cars, and light commercial vehicles), to evaluate the environmental sustainability of various economic activities.

By developing strategies that align their revenue, capital investment, or operating expenses with EU Taxonomy standards, companies can show their commitment to sustainability, access more financing options, and enhance their ESG performance. For those managing fleets and leased vehicles, this means focusing on low-emission vehicles and sustainable fleet management practices amongst other criteria.

The Corporate Sustainability Reporting Directive (CSRD)

The Corporate Sustainability Reporting Directive (CSRD) is a pivotal European Union initiative aimed at improving the quality and enhancing the scope of companies’ sustainability reporting.

It replaces the previous Non-Financial Reporting Directive (NFRD) and expands the requirements for companies to disclose their environmental, social, and governance (ESG) performance.

The CSRD has a broader scope and extends its requirements to include all large companies and listed small and medium-sized enterprises (SMEs) in the EU, of a total of approximately 50,000 companies. Non-EU companies with significant operations in Europe are also required to comply.

Companies must adhere to detailed and standardized reporting requirements that cover a wide range of ESG factors, with the goal of reaching greater consistency and comparability across industries.

The directive emphasizes double materiality, meaning companies must consider both the impact of ESG issues on their financial performance and the impact of their operations on the environment and society. This allows companies to assess and focus on their most material ESG areas and significantly increases transparency and accountability, providing investors and stakeholders with reliable ESG data.

For companies, beyond the vast effort to collect the sheer volume of information required, this means integrating ESG considerations into their core business strategies, including comprehensive reporting on fleet and leased vehicles.

The Carbon footprint and EU Taxonomy described before are encompassed in a company’s new CSRD Compliant Sustainability statement. The CSRD mandates comprehensive disclosure regarding a company's transition plan to a low-carbon economy. This includes full disclosure of the carbon footprint in accordance with GHG Protocol guidelines. Additionally, companies are expected to disclose their policies, actions, and targets related to climate change mitigation.

How to report on employees’ mobility, your fleet, and leased vehicles – and their impact on carbon emissions

Accurate and transparent reporting with regards to mobility, corporate fleets, and leased vehicles enables you to clearly identify opportunities to reduce emissions, that may also coincide with cost optimization, and, overall, improve the sustainability of your operations. This, in turn, enables you to demonstrate a strong commitment to sustainability, transparency, and meeting regulatory requirements.

Here are some key strategies for effectively reporting and reducing emissions:

- Measure and monitor emissions

Include emissions from leased vehicles and employee commuting in your carbon footprint calculations. Use standardized methodologies, such as those from the Greenhouse Gas Protocol, to ensure accurate reporting.

Data is key to succeed in this endeavor, implementing for instance telematics systems to track fuel consumption, mileage, and driving behavior will provide insights into vehicle efficiency and identify areas for improvement.

Such valuable information can fuel your decision making and fleet strategies as well as nurture change management programs with drivers to foster optimized usage and therefore reduced emissions.

- Switch to low-emission vehicles where possible

One of the main levers you can use to reduce emissions is to gradually transition from internal combustion engine (ICE) vehicles to electric or hybrid options wherever possible, both for owned and leased cars and vans.

Although BEVs initially produce more carbon emissions during manufacturing compared to their ICE counterparts, they emit significantly less during operations, resulting in a more advantageous lifecycle footprint than combustion engines.

To support this initiative, you need to evaluate total cost of ownership and carbon emissions, as well as potential savings from reduced fuel and maintenance costs.

- Incentivize sustainable choices

Offer incentives to employees who choose low-emission or shared transportation options for commuting and business travel.

Encourage employees to use public transport or carpool, reducing the carbon footprint of commuting, and support active transportation where possible (via cycling or using electric bikes, for example).

- Set clear targets and KPIs

Set specific, measurable targets to reduce emissions from fleet and employee mobility and look for areas you can improve continuously. Use KPIs to track fleet efficiency, emissions per mile, and employee travel modes to monitor and report performance.

Use integrated systems and software tools to collect and analyze data from various sources, ensuring consistency and accuracy in reporting.

Accurate and transparent ESG reporting is key for gaining the confidence of investors, consumers, and stakeholders

ESG reporting plays a crucial role in helping businesses to demonstrate their commitment to sustainability and ethical practices. By focusing on areas such as employee mobility, fleets, and leased vehicles, companies are to reduce emissions, but also optimize costs and operational efficiency.

By adopting low-emission vehicles, promoting sustainable transportation, and setting clear targets, businesses can improve their ESG performance and strengthen the trust of investors and consumers alike.

Sustainable financing instruments may even reward companies’ progress on sustainability indicators resulting in lower costs of financing.