The future of Fleet & Mobility: Key Trends shaping 2025 and beyond

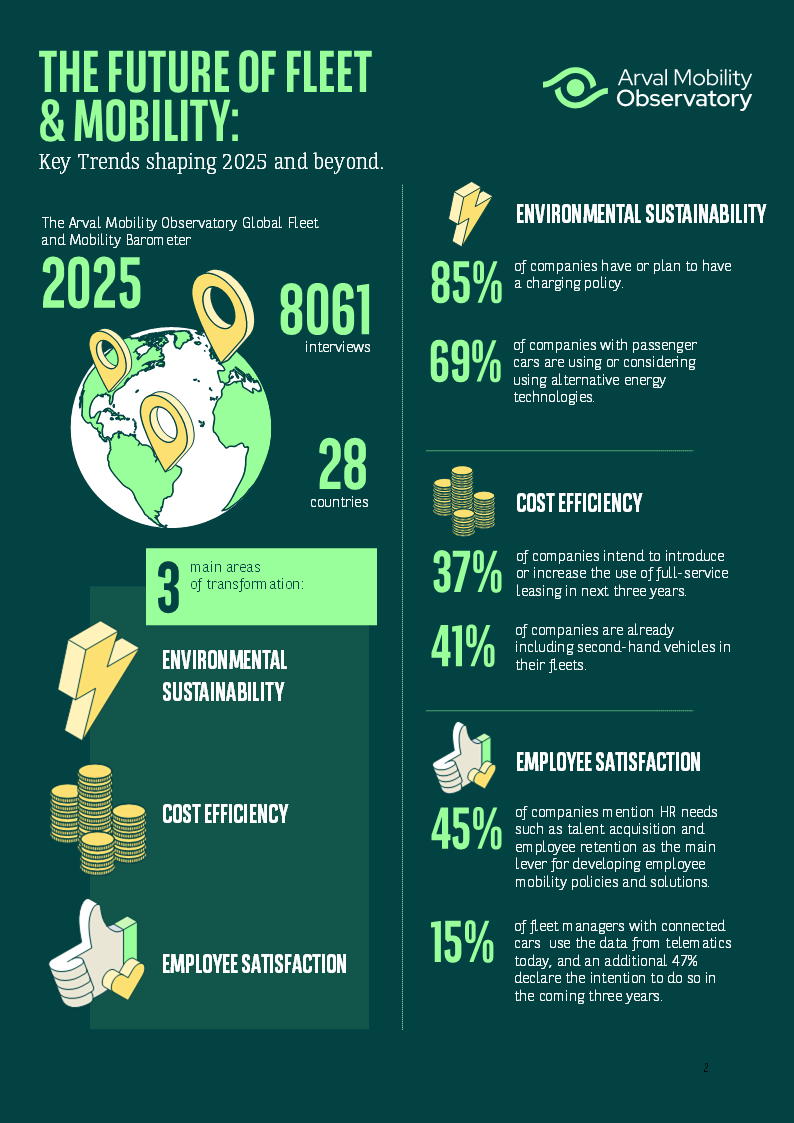

As we look ahead to the next three years, fleet managers are poised to navigate a landscape marked by significant challenges and opportunities. The Arval Mobility Observatory's Fleet and Mobility Barometer 2025 (“The Barometer”) highlights three main areas of fleet and mobility transformation, based on the main challenges and drivers expressed by the 8061 company fleet and mobility stakeholders in 28 countries; the three main areas being: environmental sustainability, cost efficiency and employees satisfaction.

1. Environmental sustainability is tightly linked to fleet electrification and companies are investing in the development of charging strategies, with 85% of the companies interviewed having a charging policy or planning to have one in the future.

One of the foremost challenges for fleet managers is the implementation of alternative energy technologies, with 34% of fleet managers mentioning it as being one of the top three obstacles to overcome in the coming three years. The report also indicates that 31% of companies view adapting to the restrictive public policies on Internal Combustion Engines (ICE) as a significant challenge. To comply with these regulations, companies are increasingly turning to alternative energy technologies and setting decarbonization goals.

The transition to electrified fleets is driven by a combination of environmental concerns, regulatory pressures and the need to reduce fuel expenses as well as aiming to improve the company image.

However, the speed of electrification is not the same when we look at passenger cars versus Light Commercial Vehicles (LCVs). According to the report, 69% of companies with passenger cars are already using or considering using at least one alternative energy technology in the next three years , such as Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), or Hybrid Electric Vehicles (HEVs). However, the adoption rates vary significantly by region, with Europe leading the way (75%) and Latin America (42%) lagging behind.

When it comes to LCV fleets, 9% of companies are already using and 12% considering to use an electric LCV (eLCV) in the next three years. In the context of operational challenges with eLCV implementation, the fleet managers seem less optimistic than before about the electrification of their commercial fleets, which is reflected by the decrease in consideration of implementing eLCVs in the next three years from 15% (2024) to 12% (2025).

Looking at the next three years, fleet and mobility stakeholders have declared that they expect 17% of their fleets to be BEVs (with 20% in Europe) and 10% composed of eLCVs (12% in Europe).These figures have remained stable or are slightly decreasing in some regions since 2023 and highlight that while electrification momentum goes on, the fleet and mobility stakeholders are cautiously optimistic about the medium term view.

The report highlights that the main obstacles to the wider adoption of electric vehicles are insufficient charging infrastructure and the higher purchase price compared to regular fuel cars. For both passenger cars and LCVs, charging infrastructure remains the constraint the most mentioned, whether at home, at company’s premises or public charging (with 67% total mentions for passenger cars and 66% mentions for LCVs).

To address these issues, companies are developing charging strategies, including installing charging points at company premises and supporting home charging for employees. A new set of questions regarding charging policies implemented by companies reveal that 85% of the companies interviewed have a charging policy or plan to have one in the future, whether it covers charging at employee’s home or at the company’s premises or using public networks. Looking more into detail and 12-month perspective, 55% of companies have already installed or plan to install charging points at their companies’ premises and 50% support or plan to support their company car drivers for the installation of their home charging points (with 98% of them totally or partially financially supporting this).

The report additionally shows that 13% of companies have set targeted decarbonization goals, with an additional 26% currently evaluating such goals. This growing awareness of corporate decarbonization underscores the importance of aligning fleet management practices with broader environmental objectives. More than half of the companies with decarbonization goals (56%) consider that their employees mobility has a moderate to significant contribution to achieving these targets.

2. Cost efficiency remains a top priority, with 41% of companies already including second-hand vehicles in their fleets.

Another major challenge is mitigating the rising Total Cost of Ownership (TCO). After several years of inflation, managing costs has become a critical concern for fleet managers. The report indicates that 31% of companies view mitigating rising TCO as a major challenge. This concern is particularly pronounced in Latin America (43%) and North America (49%), where economic conditions have led to increased operational costs, while it remains important in Europe (27%) but to a much lesser degree compared to the other regions.

To combat rising TCO, companies are exploring various financing methods. Full-service leasing remains a popular option, with 27% of companies using it as their main financing method. Furthermore, adoption of this financing method has a positive outlook, with 37% of companies intending to introduce or increase the use of this financing method in the next three years.

Another interesting finding of this year’s Barometer is that 41% of companies are already including second-hand vehicles in their fleets (vehicles that were not new when acquired by the company), with an additional 43% declaring the intention to do so in the next three years. These figures are very much consistent between the regions, although North America reports a higher use rate today (48%).

Despite the cost challenge, the report reveals that most companies remain optimistic about the future of their fleets. Overall, 91% of companies anticipate that their fleets will either remain stable or increase over the next three years, with 27% expecting growth. This optimism is driven primarily by business development and HR-related needs. The growth potential is particularly strong in North America and Europe, where companies are more likely to invest in fleet expansion.

3. Companies are repositioning the employees in the centre of mobility and fleet transformation, 45% of companies mentioning HR needs such as talent acquisition and employee retention as being the main reasons for developing employee mobility policies and solutions.

This year’s Barometer showcases the employee’s growing influence in the decision-making process of corporate mobility stakeholders.

32% of companies highlight promoting responsible driving as a main challenge, so there is a clear need to focus on driver behaviour and safety. The use of telematics and connected vehicle technologies plays a significant role in addressing this challenge. The Barometer reveals that 40% of companies have adopted telematics tools. Interestingly though, there seems to be a “say-do gap” when it comes to the use of data from telematics, with only 15% of fleet managers with connected cars using the data today, but an additional 47% declaring the intention to do so in the next three years.

Telematics data is primarily used for vehicle security and geolocation (36%), improving driver behaviour and safety (32%) and to improve operational efficiency (27%). By leveraging this data, companies can implement targeted strategies to promote safer driving practices, reduce accidents, and enhance overall fleet performance. This focus on responsible driving not only improves safety but also contributes to cost savings and environmental sustainability.

In addition to the challenges mentioned above, embracing mobility solutions is becoming increasingly important for fleet and mobility stakeholders, driven by HR-related needs, such as talent acquisition and employee retention (with at least 45% of respondents mentioning it). The mobility policies[1] and solutions[2] are seen also as a driver for environmental sustainability, especially in Europe where companies tend to prioritize CSR policies – considered as a lever for mobility policies implementation by 50% of companies in Europe and for mobility solutions by 47%.

Regarding the adoption rate, mobility policies are being used or considered in the next three years by 79% of companies globally, while mobility solutions are being used or considered in the next three years by 60% of companies globally, showing that solutions which require change management and investment from fleet and mobility stakeholders take longer to be implemented.

Within the range of mobility solutions we see that car sharing stands out as a popular option in both in usage and consideration (23%), and there is a clear interest in the development of bike leasing (while only 4% of companies declare using it today, 8% consider to do so in the next three years). When it comes to mobility policies, the most used ones are public transport expense reimbursement (20%), car or cash allowance (17%), and short/mid-term rental vehicles (17%).

Implementing mobility solutions not only addresses employee needs but also contributes to overall mobility efficiency and sustainability. By offering a variety of mobility options, companies can reduce their reliance on traditional company cars and promote more sustainable transportation practices.

"The Arval Mobility Observatory's Fleet and Mobility Barometer 2025 underscores the critical need for a balanced approach to fleet and mobility management, addressing environmental, economic, and employee-related challenges. While the transition to electrified fleets faces obstacles such as charging infrastructure and purchase prices, these challenges also present opportunities for innovation and growth. Companies are developing charging strategies and exploring cost-efficient financing methods, such as full-service leasing and incorporating second-hand vehicles into their fleets. Additionally, the focus on employee mobility policies and solutions not only addresses HR needs but also contributes to overall fleet efficiency and sustainability. By leveraging telematics and connected vehicle technologies, companies can promote safer driving practices, reduce accidents, and enhance operational efficiency. Ultimately, the Barometer 2025 emphasizes that by transforming these challenges into catalysts for change, companies can successfully navigate the future of fleet and mobility management"

Oana Duma, Head of Arval Mobility Observatory

Methodology 2024/2025

For this independent survey, 8 061 companies decisions maker interviews were carried out between August 26th 2024 and November 06th 2024 for 28 countries by an independent research company, Ipsos. Participants were recruited and interviewed by telephone . Its scope covers 28 countries: Austria, Germany, Belgium, Spain, France, Greece, Italy, Luxemburg, the Netherlands, Poland, Portugal, UK, Czech Republic, Slovakia, Romania, Switzerland, Finland, Denmark, Norway, Sweden, Mexico, Canada, USA, Turkey, Morocco, Chile, Peru and Brazil. The companies in scope operated at least one vehicle.

The distribution of the interviewees was as follows:

- 53 % were companies with less than 1 to 99 employees

- 27 % were companies with 100 to 249/499/999* employees (*dependent on market)

- 20 % were companies with 250/500/1000* employees or more (*dependent on market)

[1] The List of Mobility Policies tested in the Barometer 2025 was the following: Public transport expense reimbursement, Personal vehicle expense reimbursement, Mobility Budget, Private lease or salary sacrifice, A short or mid term rental vehicle, Car or cash allowance

[2] The List of Mobility Solutions tested in the Barometer 2025 was the following: Car sharing, Ride Sharing, Bike Leasing, Bike Sharing, Scooter or Moto Leasing, An app provided by the company to book multiple mobility solutions, A card provided by the company to pay multiple mobility solution